Picture supply: Getty Photographs

Investing in equities with a Shares and Shares ISA isn’t for everybody. Regardless of their superior common returns, some individuals choose the comfort, the assured return, and the security that merchandise just like the Money ISA present.

Share investing doesn’t essentially imply people have to tackle extreme threat nevertheless. The multitude of funding trusts and funds out there at the moment means buyers can goal life-changing returns in a shares ISA with out having to endure vital threat.

Right here’s what I simply purchased

Take the instance of the L&G Cyber Safety ETF (LSE:ISPY). That is an exchange-traded fund (ETF) I lately bought for my very own portfolio.

Corporations that assist companies and people defend themselves in opposition to on-line threats have vital development potential. In accordance with Statista, the broader cybersecurity sector’s set to develop at a mean of seven.6% every year by means of to 2029.

Buying any particular person tech shares is a high-risk endeavour. As a result of sector’s fast-paced evolution, market leaders could battle to take care of their aggressive edge over time. And for cyber safety suppliers, any high-profile programs failure can depart their status (and future gross sales prospects) in tatters.

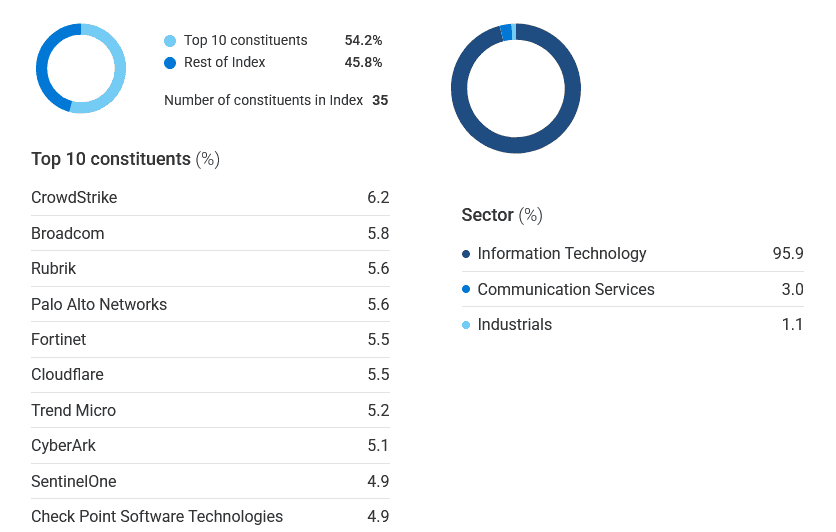

By investing in a product like this L&G Cyber Safety, I can reduce (if not completely eradicate) the probabilities of my holdings turning into out of date. The fund invests in dozens of tech companies throughout the data expertise, telecommunications and industrials sectors.

Nevertheless, it nonetheless gives glorious publicity to among the cybersecurity trade’s largest and most revolutionary gamers:

£400 a month = £1m?

It’s a standard false impression that diversifying like this implies buyers should accept mediocre returns. Nobel-prize-winning economist Harry Markowitz famously referred to as diversification a “free lunch“, the place buyers can improve security with out compromising long-term returns.

L&G Cyber Safety’s efficiency over the previous decade proves this completely. Since its creation in September 2015, it’s offered a mean annual return of roughly 11%.

If this have been to proceed, somebody placing £300 on this fund every month would — after 30 years — have a £1.1m nest egg (excluding buying and selling charges) to retire on.

Different choices

That’s all nicely and good. However some buyers could also be sceptical that the cybersecurity trade can ship the form of development that the likes of Statista count on.

The excellent news is that the ETF market has exploded, and people have hundreds of those lower-risk devices to select from. Traders can acquire publicity to totally different sectors, areas, themes, and may tailor the quantity of threat they with to tackle.

The Xtrackers MSCI World Momentum fund, for instance, holds shares in 360 world firms. These vary from Apple and Walmart within the States, by means of to non-US shares like Unilever, Siemens and Ferrari.

As you’ll be able to see, this gives even higher diversification for buyers. And what’s extra, its return during the last decade is even greater, at 11.8%.

ETFs like these can nonetheless fall in periods of market volatility. However over the long run, I consider they’re enticing methods to contemplate concentrating on retirement wealth with out taking up extreme threat.