Picture supply: Getty Photographs

Considerations over a possible US recession have plunged inventory markets into turmoil. Many FTSE 100 and FTSE 250 shares supply vital parts of their earnings from the world’s largest financial system. What’s extra, bother within the US could have large ramifications throughout the globe.

Which means that buyers who depend on dividend earnings for his or her investing technique or on a regular basis bills needs to be cautious about which shares they spend money on.

On this panorama, it may very well be a good suggestion to spend money on corporations which have robust stability sheets, function in non-cyclical industries, and revel in market-leading positions and a number of income streams.

A prime FTSE 250 inventory

This checklist doesn’t prohibit me to a slim number of UK shares, nevertheless. The FTSE 250 alone is full of shares that meet a number of and even all the above standards.

Right here’s one I’d purchase for my very own portfolio if I had spare money to take a position.

Property powerhouse

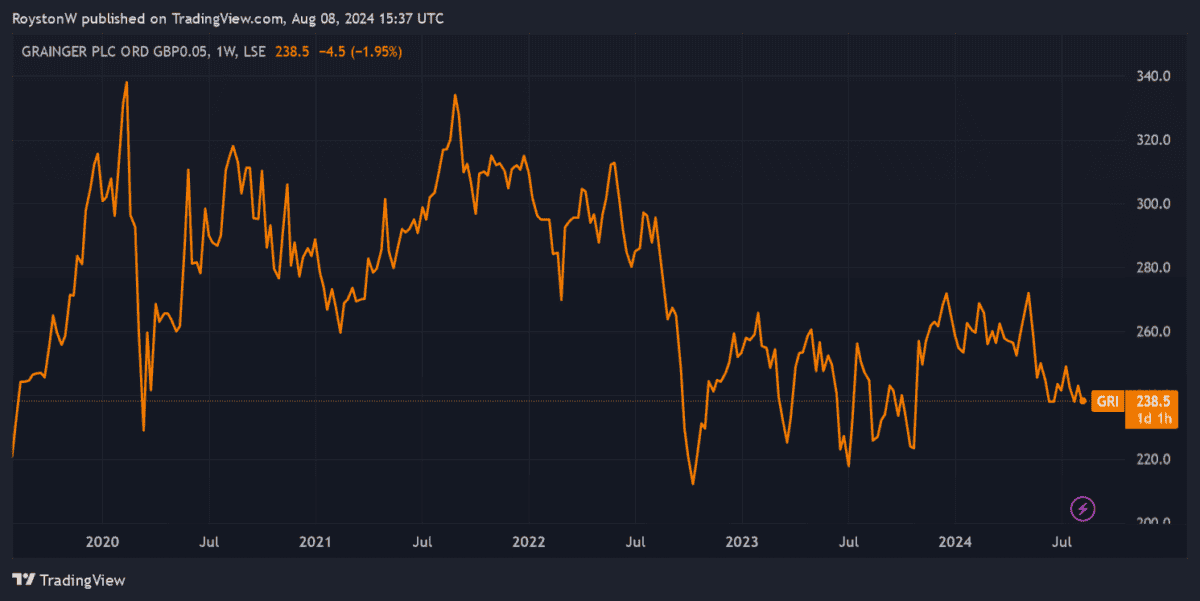

As I discussed, shopping for shares that function in defensive sectors generally is a nice thought throughout recessions. On this respect, Grainger (LSE:GRI) may very well be probably the greatest the London inventory market has to supply right this moment.

Shelter and meals are two issues people merely can’t do with out. And as a residential property landlord, this FTSE 250 firm can count on a gradual movement of earnings in any respect factors of the financial cycle. Newest financials confirmed its property occupancy at a excessive 97.7% as of March, regardless of the continuing cost-of-living disaster.

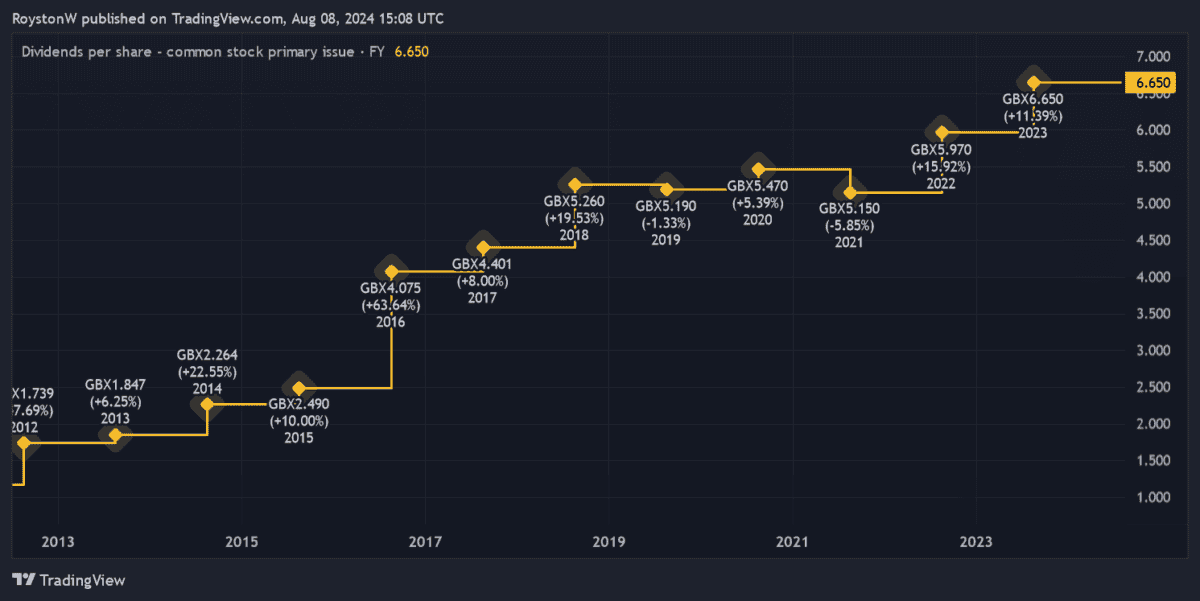

This stability has allowed it to — aside from 2019 and 2021 — develop dividends for greater than a decade. Certainly, shareholder payouts have ballooned as rental development within the UK has soared.

Like-for-like non-public rents soared 8.1% within the first half of Grainger’s monetary half. This in flip inspired the agency to boost the interim dividend by 11% yr on yr, to 2.54p per share.

Dividend development

The dearth of accessible rental properties, which is pushing rents larger, is anticipated to persist for a number of extra years a minimum of. And so Metropolis analysts count on Grainger’s dividends to proceed swiftly rising for the following three monetary durations, as illustrated beneath.

| Monetary yr* | Dividend per share | Dividend yield |

|---|---|---|

| 2024 | 7.29p | 3.1% |

| 2025 | 8.24p | 3.5% |

| 2026 | 9.11p | 3.9% |

The property big is shortly increasing to capitalise on these fertile circumstances too. As of March it had round 5,000 new rental properties in its growth pipeline so as to add to its current portfolio of simply over 11,000.

This might present the foundations for regular revenue (and thus dividend) development past the following few years. Moreover, Grainger’s development technique ought to obtain a lift from Labour’s pledge to slim down planning laws.

Having mentioned this, future dividends aren’t fully proof against threat. One fear I’ve is the corporate’s web debt pile, which rose 6% yr on yr to £1.5bn as of March. This might compromise payout development as the corporate additionally invests closely in its property portfolio.

On stability nevertheless, I nonetheless imagine Grainger stays probably the greatest dividend shares for me to contemplate in these unsure occasions.