Picture supply: Getty Photographs

The Shares and Shares ISA could make buyers wealthy over the long term, assuming a wise and knowledgeable investing technique. That’s as a result of it permits UK residents to take a position and take their features with out paying tax.

Whereas many Britons have elected to spend money on buy-to-let property as a way to earn a second or passive revenue — and it definitely may be remunerative — I personally imagine investing affords a a lot better option to become profitable.

It’s a quite simple course of: open a Shares and Shares ISA, after which make month-to-month contributions whereas investing that cash properly. Stick with it for a very long time and returns will compound closely.

Sadly, investing isn’t one thing us Britons do nicely. Within the UK, adults maintain the smallest quantity in equities and mutual funds of any G7 nation at simply 8%. In truth, UK has been backside of the G7 league for funding in 24 out of final 30 years.

I genuinely imagine that if this pattern continues, we’ll grow to be infinitely poorer in contrast with our worldwide friends.

Please be aware that tax therapy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

A six-figure passive revenue

Throughout a complete portfolio invested in dividend paying shares, it’s doable to sustainably, for my part, obtain a median yield of 5%. That is the cash paid within the type of dividends and acquired by the shareholders, free from tax. As such, as a way to earn £100,000 in passive revenue, an investor would wish a portfolio value £2m. That may sound like a tall order, however with time, it’s very achievable.

The reply lies in compounding. That is when the returns get bigger and bigger every year because the pot will get greater. As such, the longer buyers depart cash available in the market, assuming they will nonetheless match earlier efficiency, the quicker the cash grows.

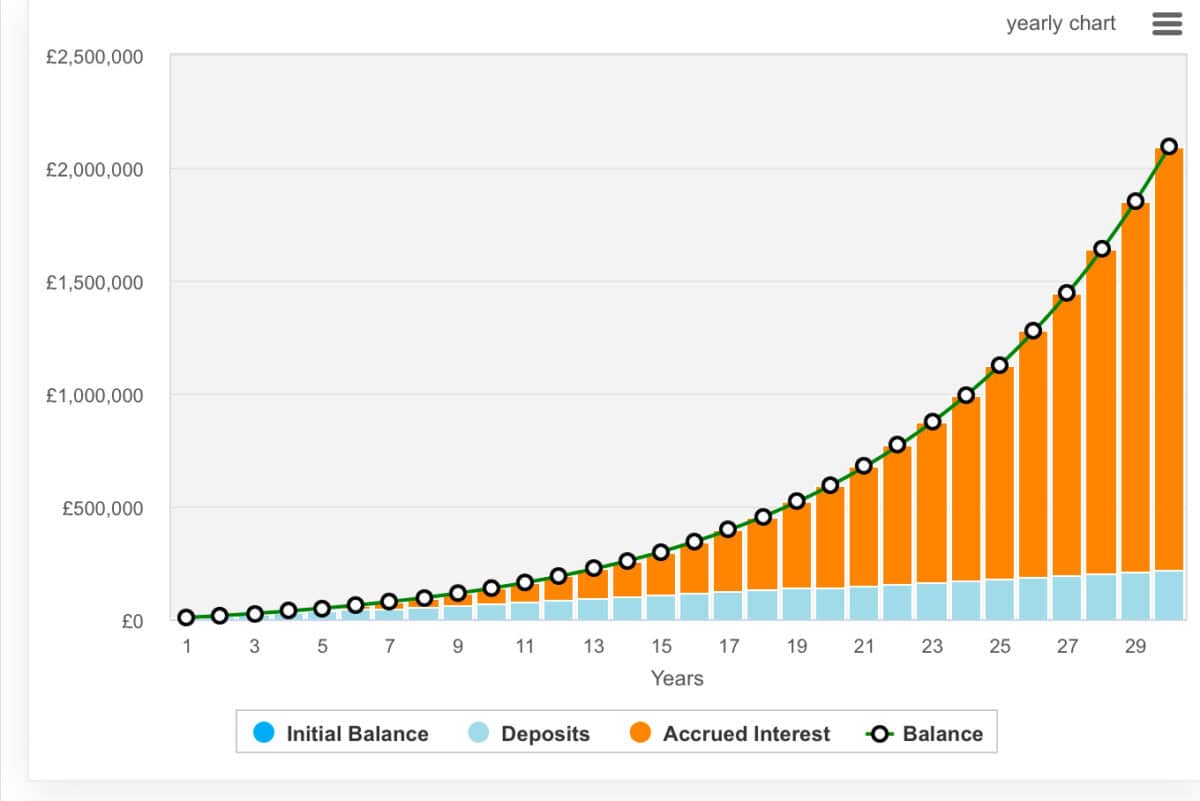

Simply check out this instance. Right here, an investor places apart £600 a month for 30 years whereas averaging a powerful, however achievable, 12% annualised return. The expansion in the direction of the tip of the interval’s actually excellent.

For additional context, this portfolio would develop by £238k within the last 12 months. Even in 29 years, that may nonetheless characterize a powerful single-year wealth achieve. Okay, it’s not assured, however I’d have to earn over £500k in a salaried job to pocket that sort of cash.

A inventory for consideration

Palms-off buyers could want to begin by contemplating funds or trusts like Scottish Mortgage Funding Belief. Or these searching for a extra lively method could like to contemplate an undervalued inventory like Jet2 (LSE:JET2). This AIM-listed airline trades at an enormous low cost to lots of its friends.

Jet2’s web money place is a key power, projected to surge from £1.7bn in 2024 to £2.8bn by 2027. This liquidity helps expansions, together with a 9% seat capability improve for summer time 2025.

Valuation metrics spotlight upside potential. Jet2’s EV-to-EBITDA ratio is about to fall from 2.01 in 2024 to 0.52 by 2027, far under IAG’s 4.7. The value-to-earnings ratio of 8.1 instances and a price-to-earnings-to-growth (PEG) ratio of 0.76 reinforce its undervaluation.

Dangers embody publicity to gasoline costs and demand shocks. What’s extra, its 17.7% gross margin lags IAG’s 27%, and an growing older fleet could require greater capital expenditure. Nonetheless, it’s a inventory I’ve not too long ago purchased.