Picture supply: Getty Pictures

Producing passive earnings from investments is a worthwhile monetary objective, and an Particular person Financial savings Account (ISA) is a wonderful automobile for attaining it. For UK buyers in search of to earn £3,000 in month-to-month passive earnings figuring out the required ISA stability, and the right way to get there, includes some shrewd planning.

Hitting the goal

A widely-used benchmark is the 4% rule. This means an investor can withdraw 4% of their portfolio yearly with out considerably depleting their capital long run — this may very well be achieved by investing in dividend-paying shares with a mean yield of 4%. Primarily based on this, an investor would want £900,000 of their ISA to generate £3,000 a month.

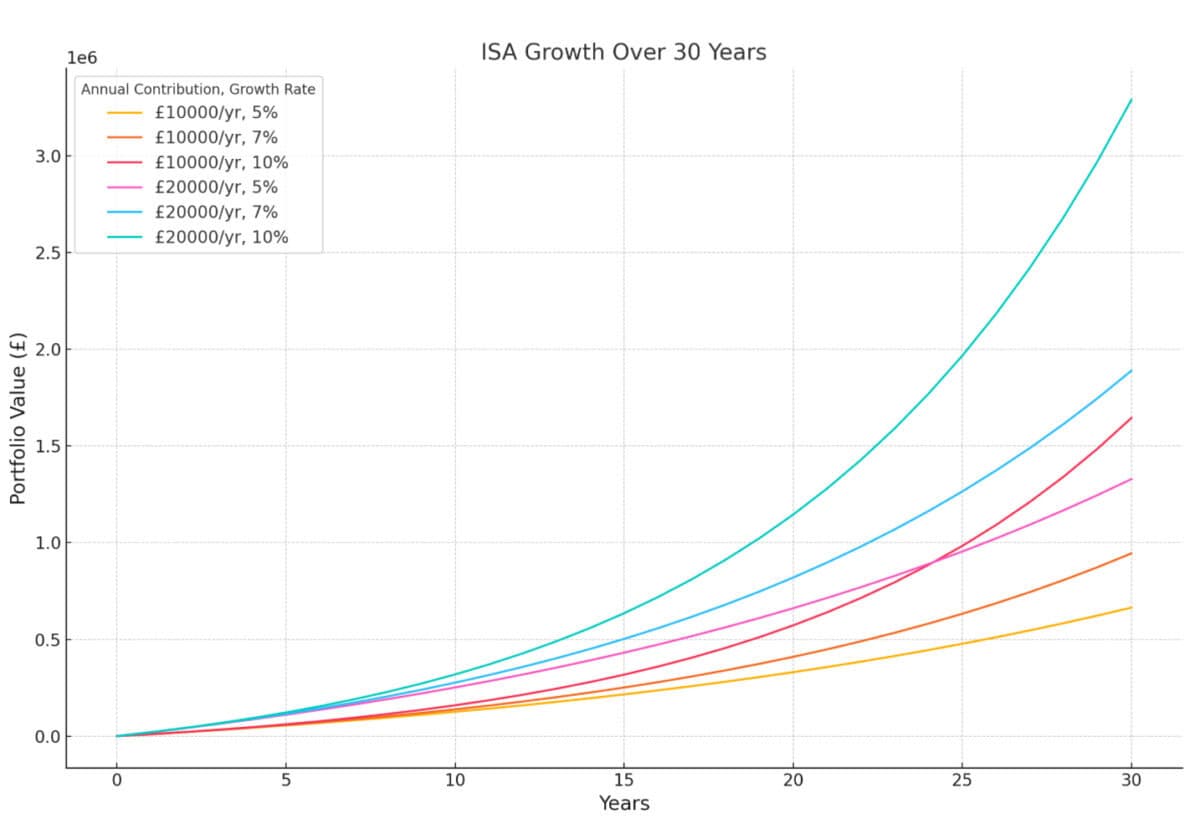

Attaining this stability is dependent upon a number of components, together with preliminary contributions, the time horizon, and funding returns. ISA allowances allow as much as £20,000 a tax 12 months to be contributed. By doing this and investing in property with a mean annual return of seven% (a typical expectation for shares), an investor ranging from £0 might doubtlessly accumulate round £900,000 in 25 years. After all, that’s not assured and stated investor might lose cash in addition to making it.

There are different methods to purpose for the goal. One might put money into larger dividend-paying shares in an effort to generate a bigger yield from a smaller stability. The required stability may be achieved sooner or with much less capital if the investor’s shrewd. That is highlighted within the under graph.

The artwork of the doable

Many novices will purchase into index-tracking funds. These purpose to trace the efficiency of main indexes. For instance, the FTSE 100 averaged 6.3% yearly over 20 years, whereas FTSE 250 outperformed it. America’s S&P 500 returned about 10.5% yearly since 1957, averaging 13.3% within the decade to 2024. The Nasdaq achieved 19.8% over the previous decade.

However some folks, these shopping for into particular person shares and funds, obtain stronger progress. Whereas I’ve averaged robust double-digit returns over the past 5 years, brain-boxes like analyst J Mintzmyer have averaged over 40%. Nonetheless, as nice as this sounds, buyers must do not forget that poor funding selections can lead to shedding cash.

Contemplate this for the expansion section

I usually put money into particular person shares, however in my daughter’s Self-Invested Private Pension (SIPP), which includes smaller investments, I desire funds or trusts that supply me diversification whereas solely paying one platform buying and selling payment.

One belief she lately purchased and I feel is price contemplating is Edinburgh Worldwide Funding Belief (LSE:EWI). It’s operated by Baillie Gifford, which additionally runs the favored Scottish Mortgage Funding Belief.

Like Scottish Mortgage, Edinburgh Worldwide invests in growth-oriented corporations however centered on making an preliminary funding in corporations when they’re youthful — initially corporations with a market-cap smaller than $5bn, however this was lately upped to $25bn to broaden the sector of play.

Its largest funding is SpaceX which represents an enormous 12.3% of the portfolio. That is adopted by PsiQuantum at 7.5% and Alnylam Prescription drugs. In brief, it’s a really attention-grabbing portfolio, representing among the most sought-after progress investments worldwide.

Nonetheless, SpaceX and quantum computing go some solution to highlighting the dangerous nature of the belief’s holdings. Not solely are these early-stage corporations — albeit one price $350bn within the case of SpaceX — however there’s restricted accessible information about their funds — solely listed corporations must subject earnings experiences.