Picture supply: Getty Photographs

Harbour Power (LSE: HBR) is a FTSE 250 oil and fuel firm primarily based in London. With a £4bn market cap, it’s not solely the second-largest on the index but in addition at present bigger than the ten smallest on the FTSE 100. Consequently, it foremost rejoin the primary index within the subsequent reshuffle.

It bought demoted from the FTSE 100 in late 2022 after its market cap collapsed beneath £3bn. Nevertheless, it catapulted again above £4bn once more in early September final yr after finalising the acquisition of the upstream property of German oil and fuel producer Wintershall Dea.

The acquisition represents a major growth for the corporate, pushing manufacturing as much as 475,000 barrels of oil equal per day (boepd). Based on a press launch, it’s now “one of many world’s largest and most geographically numerous unbiased oil and fuel corporations.”

Assessing viability

Harbour definitely appears to be enthusiastically increasing its enterprise however oil and fuel is a troublesome trade. Prospecting for brand spanking new wells could be costly and at occasions, can yield no returns. Many unbiased corporations expertise lengthy intervals of losses and mounting debt with no assure of a restoration.

When assessing oil and fuel corporations, it’s vital to contemplate what number of years of reserves they maintain. The potential worth of an as-yet untapped reserve is determined by its industrial viability.

Profitable explorations quantity to property on the steadiness sheet after which slowly lower as they’re depleted. As incoming money is used to fund new explorations, the corporate can shortly fall again right into a low valuation.

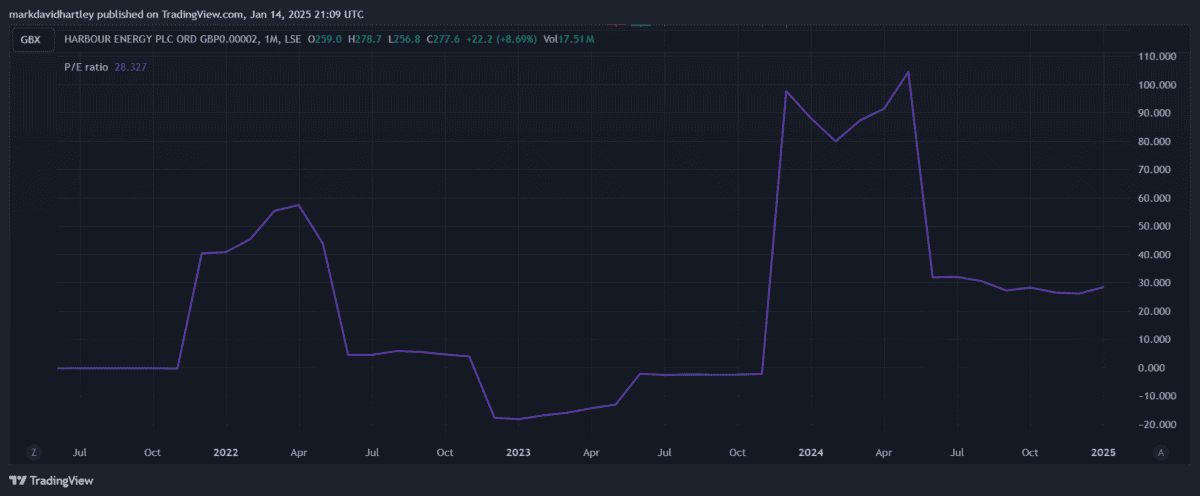

Thus, precisely assessing the funding viability of an oil and fuel firm can show troublesome. That is usually made most evident by a wildly fluctuating price-to-earnings (P/E) ratio.

Worth and dividends

Within the graph above, we will see how Harbour’s trailing P/E ratio has moved in a spread between -18 and +105 over the previous few years.

At present, it’s constructive and sits round 28, which appears to be like costly for traders contemplating it now. However the latest enhance in manufacturing means earnings are forecast to enhance considerably, so it has a ahead P/E ratio of solely 10.

Which means the present share value of 277p could possibly be very low cost, prompting analysts to forecast a mean 12-month value goal of 370p — a 33% improve!

An additional 8% in dividends on prime of that might be the cherry on prime. However with virtually no monitor document of funds, it’s unattainable to say whether or not its dividends are dependable.

With no regular or constant money movement, power corporations could be unreliable relating to dividends. Final yr, for example, Diversified Power Firm slashed its dividend and the yield fell from 15% to 7.2%.

Subsequently, I wouldn’t issue within the dividend when assessing the long-term worth of Harbour.

Additional developments

However in December 2024, Harbour loved additional excellent news. In cooperation with companion Ithaca Power, it found hydrocarbons within the Jocelyn South prospect within the North Sea. In fact, whereas the invention is promising, the industrial viability of it nonetheless must be evaluated. As ever, there’s a threat it may price rather a lot and quantity to little.

Whereas Harbour’s developments appear promising, I don’t plan to purchase it right now. Nevertheless, it might be value contemplating for risk-tolerant traders eager on rising power shares.